This article discusses the growing shift in post-acute care from skilled nursing facilities to home-based care. This trend has accelerated during the pandemic due to patients desiring to recover at home and Medicare Advantage realizing the lower costs associated with home-based care. Contact Sena Health today to find out more about receiving customer-centric, hospital-level care in the comfort of your home!

n

nn

The covid-19 pandemic drove a collapse in both patient volume and revenue for post-acute care in skilled nursing facilities (SNFs). And while patient numbers have increased modestly since the worst of the pandemic, they remain far below 2019 and probably are financially unsustainable for the SNFs.

nn

At the same time, bipartisan federal legislation in the House and Senate would create new incentives for post-acute patients to receive rehabilitation and other post-hospital care at home rather than in a SNF. The bill, called the Choose Home Act, would create an additional Medicare benefit for up to 30 days of in-home health services. It would allow Medicare payments for services such as telehealth, transportation, and personal and respite care.

n

Plunging Medicare spending

n

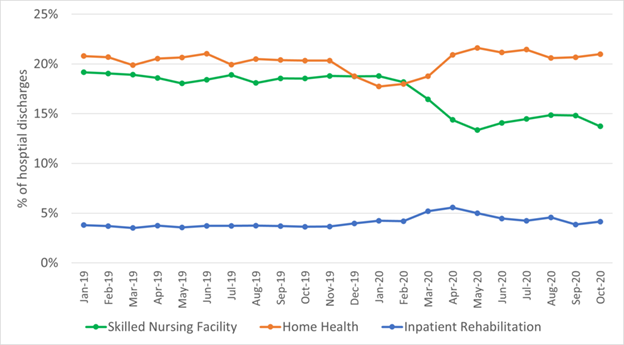

According to a new study by University of Pennsylvania researchers Rachel Werner and Eric Bresssman, the pandemic accelerated what was already a shift of these rehab-like services from SNFs to home-based health care.

nn

The study, published in the Journal of Post-Acute and Long-Term Care Medicine (JAMDA), found that Medicare spending for post-acute care plunged from $42 million a month in 2019 to $19 million by October 2020. Skilled nursing facilities accounted for about 31 percent of post-acute spending in late 2020, down from 39 percent in 2019.

n

Post-acute care generally follows hospitalization for an acute medical episode such as a stroke, or for surgery—often to repair or replace a hip or knee. Traditionally, patients were transferred to SNFs for rehabilitation, such as occupational or physical therapy. Most of these facilities operate two businesses under the same roof—post-acute services mostly paid by Medicare and long-stay care generally funded by Medicaid. The Medicare payments are critical to nursing homes because they offset low Medicaid payments for long-term care.

n

Accelerating the decline

n

Those post-hospital transfers had been declining even before the pandemic. One reason was that patients and families chose rehab at home. Another resulted from decisions by Medicare Advantage (MA) managed care plans that found at-home rehab more satisfying for its members and less costly.

nn

But those declines accelerated during the pandemic. In part, it was because for months hospitals were barred from performing elective surgeries, such as most of those knee and hip cases. However, even when those cases resumed, transfers to SNFs largely did not. Instead, patients gravitated to home health care and, to a lesser extent, inpatient rehab in hospitals.

n

Slow recovery

n

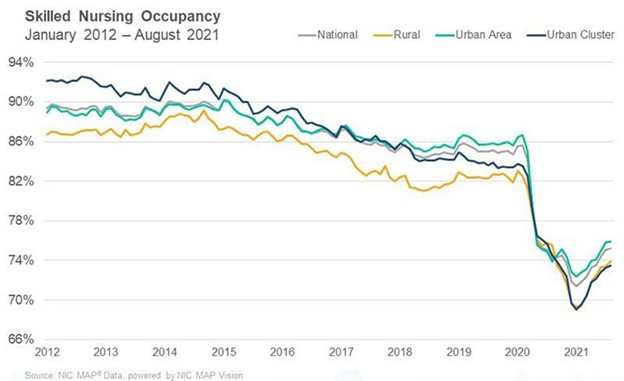

A separate survey by the National Investment Center for Seniors Housing and Care shows that by this past September, SNF occupancy (including both rehab and long-stay residents) rebounded from its bottom in January, 2021. But at about 75 percent, it still was far below its pre-pandemic level of almost 86 percent. Industry analysts generally believe that occupancy must exceed 80 percent for facilities to be profitable.

n

SNF occupancy is recovering fitfully in part due to lack of staff. The industry trade group The American Health Care Association says nursing homes lost more than 200,000 workers during the pandemic. A separate study by the research and advocacy group PHI and the University of California, San Francisco found a similar drain and no evidence that workers are willing to return to difficult low-paying jobs in long-term care. The result: Facilities are turning away patients, or even closing because they do not have enough staff to meet regulatory requirements.

n

n

And it isn’t just a lack of patients. SNFs are being paid less for those who are there. Structural changes in Medicare, by far the largest payer of post-acute services, are hitting SNFs—hard.

nn

The NIC report shows how the rapid growth of Medicare managed care is squeezing SNF margins. About 40 percent of Medicare beneficiaries are enrolled in MA plans. And while most are relatively young and healthy, a growing share of MA members need rehab services.

n

The MA squeeze

n

And the difference in payment rates between MA and traditional fee-for-service Medicare is stark and growing. At the end of August, traditional Medicare was paying an average of $562-per-day for a post-acute patient while MA paid only $445. That gap grew by roughly 20 percent just during the pandemic. Overall, August 2021 Medicare managed care revenues fell by more than 4 percent per patient, per day—or almost $20—compared to the prior year. This at a time when costs for labor and personal protective equipment were rising rapidly.

nn

This trend raises three critical questions: How much of the shift away from SNFs for lucrative post-acute care is permanent? If it is, what will become of nursing facilities as we know them? And how will the US adjust to increasing home-based care, much of it provided by unskilled and overburdened family members and friends?

nn

As it has in so many other ways, the nursing home story shows how the Covid-19 pandemic exposed deep flaws in our system of care for older adults. Now, we need to figure out what to do about it.

nn

Link to original article posted December 2, 2021 | Forbes